Every school administrator and nonprofit leader eventually confronts a fundamental question: How do we secure our organization’s future beyond annual fundraising cycles? How can we build permanent financial stability that transcends economic uncertainties, leadership transitions, and changing funding landscapes? For generations, the answer has been endowment funds—permanent capital pools that generate perpetual income supporting organizational missions without depleting the principal.

Endowment funds represent transformative financial instruments that convert one-time gifts into permanent income streams supporting institutions across centuries. When schools, universities, and nonprofits thoughtfully build and manage endowments, they create financial independence, weather economic challenges, and fulfill missions more effectively than organizations dependent solely on annual fundraising. Yet endowment development remains mysterious to many development professionals unfamiliar with these powerful tools.

This comprehensive guide explains what endowment funds are, how they work, types available to different institutions, investment strategies ensuring sustainability, and how proper donor recognition strengthens endowment growth across generations.

Understanding endowment fundamentals empowers development officers, board members, and institutional leaders to build permanent financial foundations that transform organizational capacity and mission impact for decades to come.

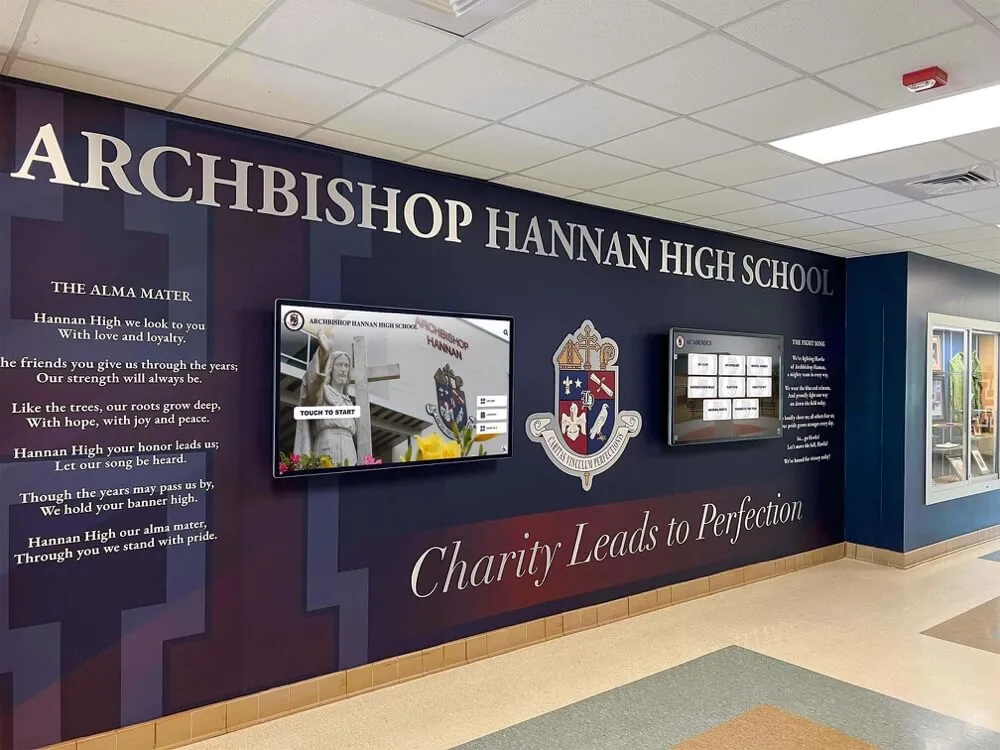

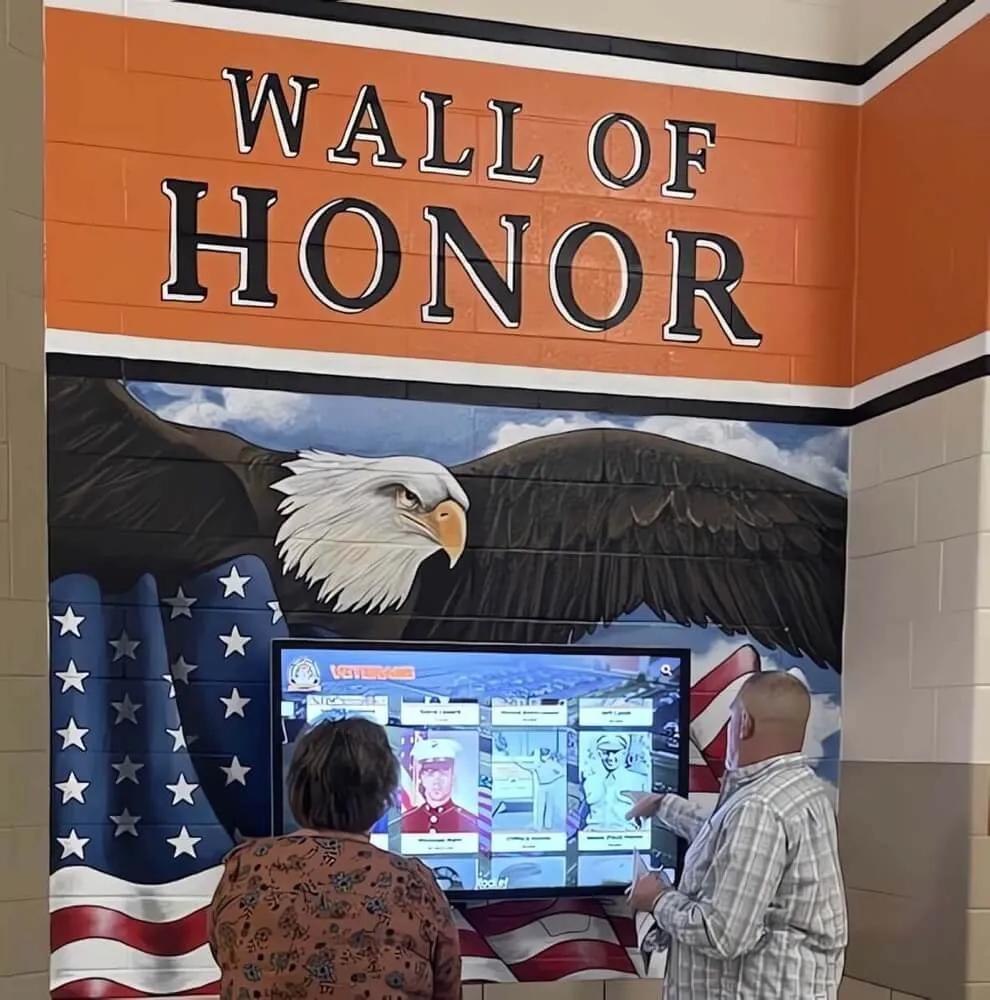

Endowment donors deserve prominent recognition that celebrates their transformational impact on institutional sustainability

What Is an Endowment Fund? Core Definition and Purpose

An endowment fund represents a permanent pool of donated capital that institutions invest conservatively, spending only a portion of annual investment returns while preserving the principal in perpetuity.

Essential Endowment Characteristics

Permanent Capital Structure Unlike annual fund gifts that organizations spend immediately, endowment contributions remain invested permanently:

- Principal amounts stay intact regardless of market fluctuations or institutional needs

- Organizations spend only a small percentage of fund value annually (typically 3-5%)

- Investment growth replenishes distributions while building long-term value

- Funds continue supporting missions across generations of beneficiaries

- Donor intent established at contribution guides fund use permanently

This permanent structure distinguishes endowments from other fundraising approaches and creates lasting institutional impact.

Investment-Generated Income Endowments support organizations through investment returns rather than principal spending:

- Professional investment managers grow fund value through diversified portfolios

- Annual distributions come from investment earnings, not donated principal

- Long-term investment horizons enable higher-return strategies

- Balanced approaches maintain purchasing power despite inflation

- Spending policies prevent overuse that would deplete funds

Research demonstrates that well-managed endowments maintain purchasing power while generating reliable annual income supporting organizational operations indefinitely.

Why Organizations Build Endowments

Financial Stability and Independence Endowments provide critical advantages over annual fundraising dependence:

- Predictable income regardless of economic conditions

- Reduced vulnerability to funding source changes

- Ability to plan long-term programs with confidence

- Freedom from constant fundraising pressure

- Capacity to weather unexpected challenges

Organizations with substantial endowments demonstrate significantly greater program stability and lower closure rates than institutions dependent solely on annual contributions.

Digital recognition systems honor endowment donors whose permanent gifts create lasting institutional impact

Mission Enhancement Capacity Permanent endowment income enables program improvements impossible with annual funding:

- Faculty positions and academic programs requiring long-term commitments

- Student scholarships providing predictable financial aid year after year

- Facility maintenance and capital reserves preventing deferred maintenance

- Program innovation and strategic initiatives advancing organizational mission

- Excellence investments distinguishing institutions from competitors

According to the National Association of College and University Business Officers (NACUBO), institutions with larger endowments per student consistently demonstrate higher program quality metrics and better mission outcomes.

Learn about comprehensive donor recognition strategies that honor endowment contributors appropriately.

Types of Endowment Funds for Educational Institutions and Nonprofits

Organizations establish various endowment types based on donor intent, institutional needs, and strategic priorities.

Unrestricted Endowments

Maximum Flexibility for Institutional Needs Unrestricted endowments provide boards and leadership with discretion over income use:

- Annual distributions support organizational priorities as determined by leadership

- Boards allocate funds addressing current strategic needs

- Institutions respond to changing circumstances and opportunities

- Maximum adaptability as missions evolve over time

- No donor restrictions limiting fund use

Organizations value unrestricted endowments for financial flexibility, though many donors prefer specifying how contributions support missions they care about deeply.

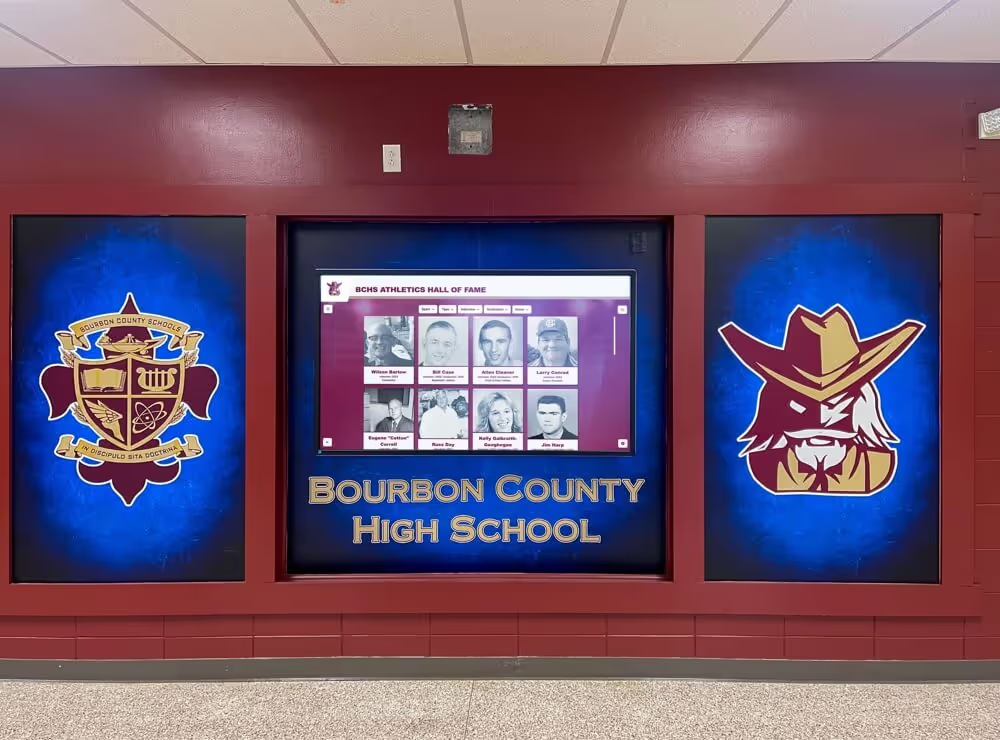

Hybrid recognition approaches honor major endowment donors through permanent physical elements while digital systems acknowledge broader support

Restricted Endowments

Purpose-Specific Permanent Support Restricted endowments designate specific uses aligned with donor values and institutional priorities:

Academic Program Endowments Support specific educational initiatives permanently:

- Endowed faculty positions (chairs, professorships) attracting distinguished scholars

- Department support funds providing program excellence resources

- Research fund endowments enabling ongoing scholarly investigation

- Academic center endowments supporting interdisciplinary initiatives

- Program-specific endowments funding particular educational priorities

Research universities particularly value endowed faculty positions that enable recruitment and retention of scholars who would otherwise accept opportunities at better-resourced institutions.

Scholarship and Financial Aid Endowments Provide permanent student support:

- Named scholarship endowments honoring donors or loved ones

- Merit-based scholarship funds recognizing academic achievement

- Need-based scholarship endowments expanding educational access

- Program-specific student support (athletics, arts, particular majors)

- Graduate fellowship endowments supporting advanced study

According to the Council for Advancement and Support of Education (CASE), endowed scholarships represent the most common restricted endowment type, reflecting donor desire to impact students directly.

Learn about academic recognition programs that celebrate scholarship recipients.

Facility and Capital Endowments Support physical plant and infrastructure:

- Maintenance endowments providing ongoing facility care

- Technology endowments funding equipment updates and replacements

- Building endowments supporting specific facility operations

- Capital reserve endowments preventing deferred maintenance

- Athletic facility endowments maintaining competition venues

These endowments address critical ongoing costs that annual fundraising often struggles to cover consistently.

Operational and Mission Endowments Support core organizational functions:

- General operations endowments providing unrestricted annual income

- Program endowments supporting specific mission activities

- Position endowments funding critical staff roles permanently

- Innovation endowments enabling strategic experimentation

- Excellence endowments advancing institutional distinction

Strategic recognition placement ensures endowment donors receive visibility commensurate with their transformational generosity

Quasi-Endowments (Board-Designated Funds)

Institutional Reserves with Endowment-Like Management Quasi-endowments function like endowments but boards retain spending authority over principal:

- Organizations set aside unrestricted funds for investment like endowments

- Boards manage quasi-endowments with endowment-like spending policies

- Principal remains available for extraordinary needs if boards choose

- Institutions build reserves without permanent donor restrictions

- Strategic flexibility preserved while achieving long-term growth

Quasi-endowments provide financial discipline and long-term growth while maintaining board flexibility for exceptional circumstances.

Endowment Fund Management and Investment Strategies

Effective endowment stewardship requires sophisticated investment approaches balancing growth, income generation, and principal preservation.

Investment Policy Development

Establishing Governance Frameworks Sound endowment management begins with comprehensive investment policies:

Policies should address:

- Investment objectives and performance benchmarks

- Asset allocation targets across investment classes

- Risk tolerance parameters and diversification requirements

- Spending policies determining annual distribution rates

- Rebalancing procedures maintaining target allocations

- Manager selection and oversight processes

- Ethical investment considerations and restrictions

- Fiduciary standards and committee responsibilities

Organizations with formal investment policies demonstrate significantly better long-term endowment performance than institutions managing funds informally.

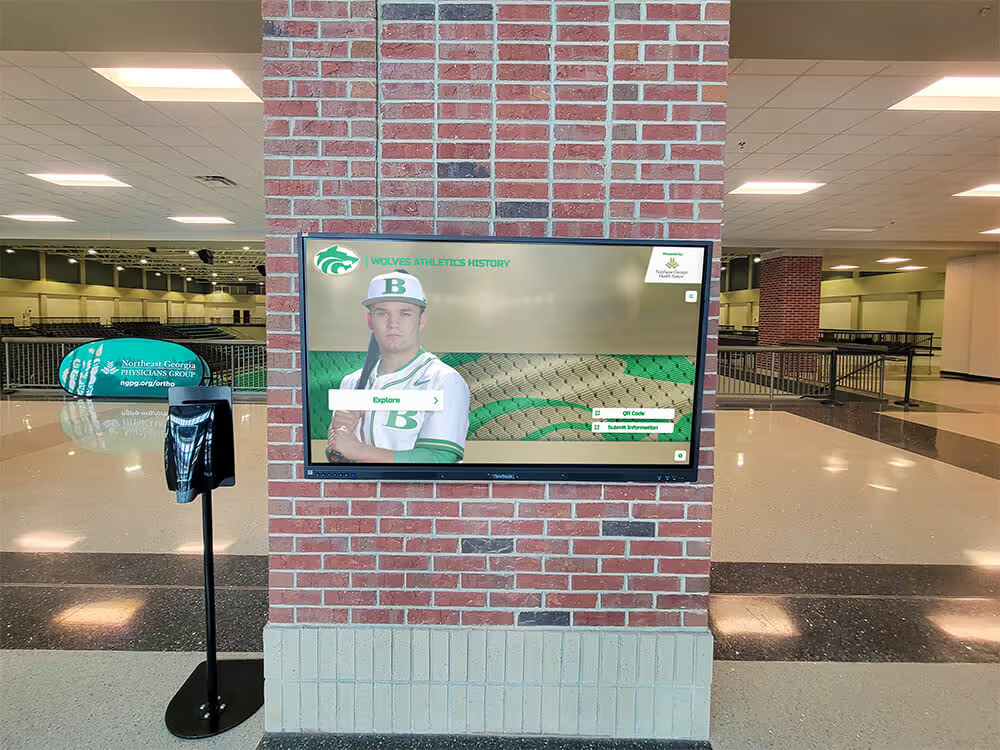

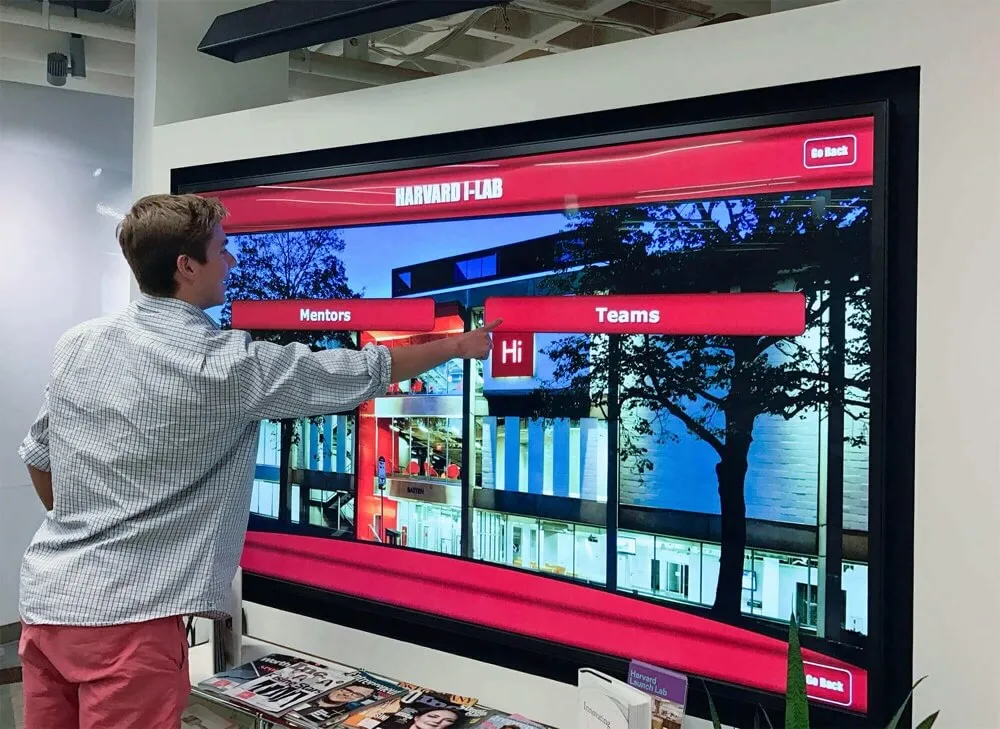

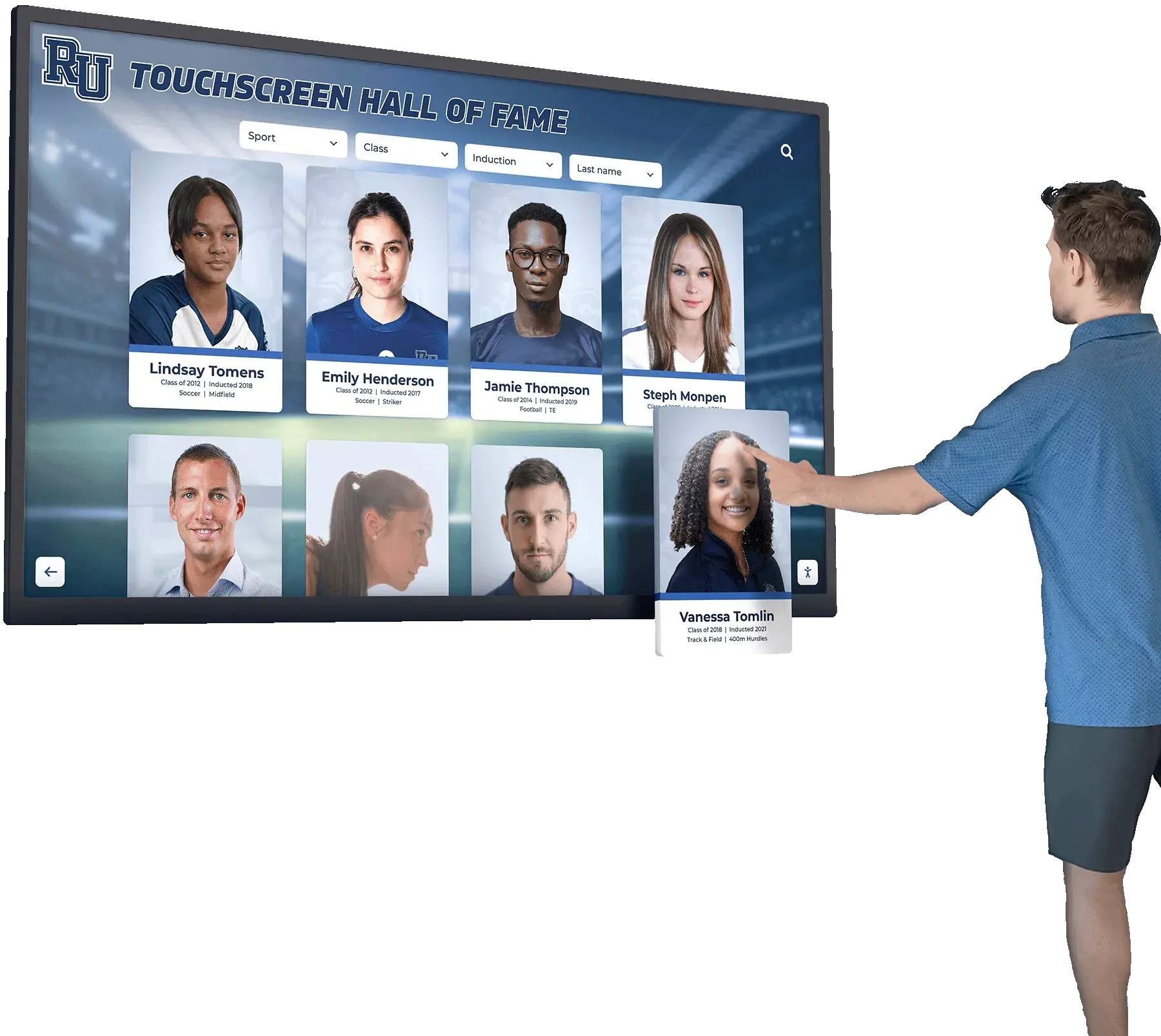

User-friendly touchscreen interfaces enable community members to explore endowment donor contributions and institutional impact

Asset Allocation Strategies

Diversified Portfolio Construction Effective endowment investment typically includes multiple asset classes:

Equity Investments (40-70% of portfolio)

- Domestic and international stocks providing long-term growth

- Public equity generating capital appreciation over time

- Private equity opportunities for sophisticated investors

- Venture capital allocations for larger endowments

- Balanced approaches across market capitalizations and geographies

Fixed Income Securities (20-40% of portfolio)

- Government and corporate bonds providing stable income

- Treasury securities offering safety and liquidity

- Municipal bonds for tax considerations when appropriate

- Investment-grade credits balancing risk and return

- Duration management matching liability timeframes

Alternative Investments (0-30% of portfolio)

- Real estate providing inflation protection and income

- Hedge funds offering portfolio diversification

- Commodities protecting against inflation

- Private investments accessing specialized opportunities

- Alternatives primarily available to larger endowments

According to NACUBO, endowments exceeding $1 billion average approximately 52% equity, 17% fixed income, and 31% alternatives, while smaller endowments maintain more conservative allocations.

Spending Policies and Distribution Rates

Sustainable Withdrawal Strategies Spending policies balance current needs with perpetual preservation:

Common Spending Policy Approaches Organizations typically adopt one of several methodologies:

- Percentage of Market Value: Spending 3-5% of trailing three-year average fund value

- Inflation-Adjusted Method: Previous year spending adjusted for inflation with market value limits

- Hybrid Approaches: Combining elements of different methodologies for stability

- Floor and Ceiling Caps: Preventing excessive variation in annual distributions

Most institutions target 4-5% spending rates, though economic conditions and investment returns may justify adjustments. Research demonstrates that spending rates exceeding 5% long-term typically erode purchasing power, while rates below 3% may underspend relative to institutional needs and donor expectations.

Learn about nonprofit donor recognition that celebrates endowment supporters effectively.

Building Endowments: Fundraising Strategies for Permanent Gifts

Developing substantial endowments requires systematic cultivation strategies that differ from annual fund approaches.

Major Gift Solicitation for Endowments

High-Touch Donor Engagement Endowment gifts typically represent donors’ most significant contributions requiring careful cultivation:

Prospect Identification and Qualification

- Capacity screening identifying donors capable of major commitments

- Affinity assessment evaluating organizational connection strength

- Previous giving analysis predicting endowment potential

- Age and life stage consideration for planned giving

- Values alignment ensuring mission connection

Development research demonstrates that endowment donors typically maintain longer relationships and higher lifetime giving than annual fund contributors before making major commitments.

Recognition design should reflect institutional character while celebrating permanent philanthropic partnerships

Cultivation Strategies for Endowment Prospects Move potential endowment donors through systematic engagement:

- Educational sessions explaining endowment impact and mechanics

- Recognition opportunities demonstrating permanent legacy establishment

- Naming opportunities providing visible, lasting acknowledgment

- Impact documentation showing how endowment income advances mission

- Planned giving integration for estate and deferred commitments

- Multi-year pledge options making large gifts achievable

- Professional advisor involvement facilitating complex gift structures

Organizations should budget 18-36 months cultivating major endowment prospects before solicitation, significantly longer than annual fund timelines.

Planned Giving and Estate Commitments

Deferred Endowment Contributions Many endowment gifts come through estate plans and deferred arrangements:

Common Planned Giving Vehicles

- Bequest intentions through wills and trusts

- Beneficiary designations on retirement accounts and insurance

- Charitable remainder trusts providing donor income before remainder to organization

- Charitable gift annuities offering guaranteed income and tax benefits

- Donor advised funds distributing grants to endowments

High-visibility placement ensures endowment recognition receives attention worthy of transformational giving levels

According to Giving USA, charitable bequests represent approximately 9% of total giving but average significantly higher than lifetime contributions, making planned giving essential for endowment building.

Legacy Society Recognition Programs Organizations should create systematic recognition for planned gift commitments:

- Legacy society membership for documented estate commitments

- Recognition events celebrating planned giving donors

- Communications sharing impact stories and stewardship updates

- Digital and physical recognition acknowledging permanent commitments

- Family inclusion options enabling multi-generational engagement

Research demonstrates that planned giving donors who receive appropriate recognition prove significantly more likely to increase estate commitments over time.

Explore donor recognition wall ideas that honor endowment contributors effectively.

Capital Campaign Integration

Comprehensive Fundraising Initiatives Major campaigns typically include significant endowment components:

Campaign Structure Approaches

- Dedicated endowment priorities alongside capital projects

- Endowment minimums ensuring campaign creates permanent support

- Challenge gifts incentivizing endowment contributions specifically

- Blended campaigns combining facilities, programs, and endowment

- Recognition structures appropriately celebrating all gift types

Successful campaigns typically designate 20-40% of total goals for endowment, ensuring that comprehensive initiatives build permanent capacity alongside immediate project funding.

Learn about booster club fundraising that can contribute to athletic endowments.

Donor Recognition for Endowment Contributors

Endowment donors deserve recognition commensurate with their extraordinary generosity and permanent institutional impact.

Naming Opportunities and Permanent Recognition

Lasting Acknowledgment for Transformational Gifts Endowment naming provides donors with visible, permanent legacies:

Facility Naming Rights Major endowments often support facility names:

- Building names for largest endowment commitments

- Room and space dedications for significant endowments

- Program area names reflecting endowment support

- Permanent signage acknowledging endowment donors

- Recognition plaques describing endowment purpose and impact

Academic Naming Opportunities Educational endowments enable scholarly recognition:

- Endowed chair and professorship names honoring donors

- Research center and institute names for program endowments

- Scholarship program names providing annual student support

- Lecture series and symposia recognizing intellectual contributions

- Academic award names celebrating donor values through recognition

Naming opportunities should reflect gift size, market standards, and institutional guidelines ensuring consistency and fairness across donors.

Digital displays provide unlimited capacity for recognizing endowment donors across all giving levels

Digital Donor Recognition for Endowment Supporters

Modern Recognition Systems Solutions like Rocket Alumni Solutions enable comprehensive endowment donor recognition:

Unlimited Recognition Capacity Digital platforms overcome space limitations:

- Every endowment donor receives prominent acknowledgment regardless of gift size

- Historical donor archives preserve institutional philanthropic legacy

- Multiple recognition categories organized by fund purpose

- Easy updates as new endowment gifts arrive

- Integrated online portals extending recognition reach

Rich Storytelling Capabilities Modern recognition enables meaningful donor profiles:

- Photography and biographical information personalizing acknowledgment

- Impact statements describing what endowment income accomplishes

- Donor testimonials explaining philanthropic motivation

- Family giving history connecting multi-generational support

- Video content bringing donor stories to life authentically

Organizations report that comprehensive digital recognition significantly improves endowment donor satisfaction and retention compared to basic plaque acknowledgment.

Real-Time Endowment Reporting Effective recognition should demonstrate fund stewardship:

- Current endowment values and investment performance

- Annual distribution amounts supporting stated purposes

- Cumulative impact metrics quantifying donor contribution effects

- Beneficiary stories showing scholarship and program recipients

- Transparent reporting building donor confidence

Research demonstrates that donors receiving regular impact communication prove significantly more likely to increase endowment commitments over time.

Discover digital donor wall solutions that honor endowment contributors appropriately while inspiring future gifts.

Endowment Stewardship and Donor Communication

Maintaining strong relationships with endowment donors requires systematic stewardship beyond initial recognition.

Annual Impact Reporting

Demonstrating Endowment Effectiveness Regular communication shows donors how endowments advance missions:

Comprehensive Endowment Reports Should Include

- Investment performance summaries and total fund values

- Annual distribution amounts and spending allocations

- Specific program accomplishments enabled by endowment support

- Beneficiary profiles and testimonials from scholarship recipients

- Financial summaries demonstrating fiscal responsibility

- Multi-year trends showing endowment growth over time

- Comparative data contextualizing institutional performance

Organizations providing detailed annual endowment reports demonstrate significantly higher subsequent gift rates than institutions offering minimal communication.

Endowment recognition should integrate seamlessly with institutional identity while celebrating philanthropic partnership

Special Events and Engagement

Cultivation Activities for Endowment Donors Ongoing engagement maintains relationships and inspires additional support:

Exclusive Recognition Opportunities

- Annual endowment society gatherings celebrating major donors

- Behind-the-scenes access to programs supported by endowments

- Meetings with faculty, students, and program beneficiaries

- Investment committee presentations for interested donors

- Private tours and special programming for major contributors

Beneficiary Connection Programs Create meaningful relationships between donors and impact:

- Scholarship recipient introductions to endowment donors

- Student presentations at donor recognition events

- Faculty acknowledgment of endowed position support

- Program director updates on endowment-funded initiatives

- Alumni testimonials from former scholarship recipients

Research demonstrates that donors meeting beneficiaries directly report significantly higher satisfaction and typically increase support over time.

Learn about alumni event ideas that can incorporate endowment donor recognition.

Common Endowment Challenges and Solutions

Organizations building endowments encounter predictable obstacles requiring strategic responses.

Challenge: Starting Small Endowments

Building from Limited Beginnings Most organizations begin endowment development with modest assets:

Growth Strategies for Small Endowments

- Set minimum thresholds ensuring investment efficiency (typically $25,000-$50,000)

- Pool smaller gifts until reaching investment minimums

- Use community foundation endowment programs reducing administrative burden

- Focus early efforts on planned giving generating larger eventual contributions

- Educate board and leadership about long-term compound growth potential

Research demonstrates that endowments under $1 million often benefit from community foundation partnerships providing professional investment management at lower cost than independent administration.

Challenge: Balancing Current Needs and Future Growth

Short-Term Pressures versus Long-Term Thinking Organizations struggle resisting pressure to overspend endowments:

Sustainability Protection Strategies

- Formal spending policies preventing imprudent distributions

- Board education about intergenerational equity principles

- Transparent reporting showing long-term value erosion from overspending

- Separate accounting preventing endowment-operating fund confusion

- Underwater endowment protocols preventing principal invasion

Accessible placement ensures endowment recognition engages diverse stakeholders throughout institutional communities

Financial professionals emphasize that endowment sustainability requires resisting short-term spending temptations that compromise perpetual mission support.

Challenge: Donor Restrictions and Flexibility

Managing Restricted Fund Limitations Overly specific donor restrictions can limit endowment usefulness:

Balancing Donor Intent and Institutional Flexibility

- Educate donors about broad designation benefits enabling adaptation

- Include variance clauses allowing modified use if original purposes become impossible

- Encourage unrestricted endowments providing maximum institutional flexibility

- Develop policies for modifying restricted endowments when circumstances change

- Court approval processes for cy pres adjustments when necessary

Development officers should guide donors toward purposeful but flexible restrictions that accommodate future institutional evolution.

Endowment Success Stories: Impact Across Organization Types

Real examples demonstrate endowment power across institutional contexts.

Educational Institution Endowments

Transformational Impact on Schools and Universities Educational endowments enable mission advancement impossible through annual funding:

- Small liberal arts colleges maintaining distinctive programs that larger competitors eliminated due to cost pressures

- Public universities establishing merit scholarship programs competing with private institution financial aid

- Independent schools providing need-based assistance expanding socioeconomic diversity

- Community colleges supporting workforce development programs serving regional economies

- K-12 schools funding faculty professional development and instructional innovation

According to NACUBO, the average college or university endowment spending provides 8-12% of operating budgets, with substantial variation based on institutional type and endowment size.

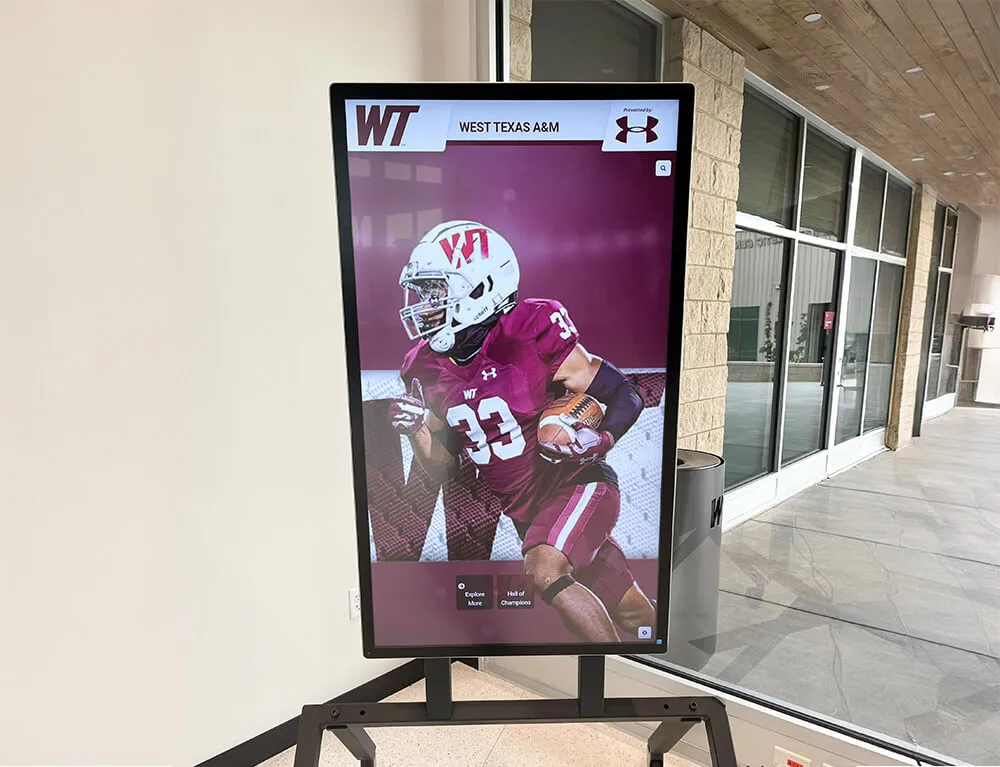

Interactive exploration enables stakeholders to understand endowment donor impact comprehensively

Nonprofit Organization Endowments

Permanent Mission Support Beyond Education Diverse nonprofits leverage endowments for sustainability:

Healthcare Organizations

- Hospitals maintaining charity care programs serving uninsured patients

- Medical research institutes funding scientific investigation

- Community health centers supporting underserved populations

- Mental health organizations providing critical services

- Public health initiatives addressing preventable diseases

Cultural and Arts Organizations

- Museums preserving collections and providing free admission

- Theaters supporting artistic programming and community access

- Symphony orchestras maintaining artistic excellence

- Public libraries expanding services and collections

- Historic preservation organizations protecting cultural heritage

Social Service Organizations

- Human service agencies providing safety-net support

- Youth development organizations offering educational programs

- Food banks and hunger relief organizations serving communities

- Homeless services providers offering comprehensive assistance

- Family support organizations preventing crises

Research demonstrates that nonprofits with endowments exceeding one year’s operating budget show significantly lower closure rates and better program outcomes than organizations without financial reserves.

Explore interactive display technology that enhances endowment donor recognition.

Starting Your Endowment: Implementation Steps

Organizations beginning endowment development should follow systematic approaches ensuring strong foundations.

Phase 1: Planning and Preparation

Foundational Work Before Fundraising

Establish governance and policies:

- Board resolution authorizing endowment creation and management

- Investment policy development or community foundation partnership

- Spending policy adoption ensuring sustainability

- Accounting procedures separating endowment from operating funds

- Gift acceptance policies addressing endowment contributions

- Recognition guidelines appropriate for transformational gifts

Engage professional advisors:

- Investment consultants for portfolio management guidance

- Legal counsel for gift agreements and endowment documents

- Accounting firms ensuring proper financial reporting

- Planned giving specialists for deferred gift expertise

- Fundraising consultants for endowment campaign planning

Thorough planning prevents future governance challenges and positions organizations for endowment success.

Integrated recognition celebrates both athletic achievement and endowment donors supporting programs

Phase 2: Case Development and Donor Education

Building Philanthropic Rationale

Develop compelling endowment cases:

- Mission impact statements explaining permanent support needs

- Financial projections demonstrating endowment income effects

- Naming opportunity inventories appropriate for major gifts

- Recognition plans honoring endowment donors appropriately

- Impact examples from peer organizations with established endowments

Educate prospective donors:

- Information sessions explaining endowment mechanics and benefits

- One-on-one meetings with high-capacity prospects

- Written materials clarifying gift structures and tax advantages

- Planned giving seminars covering estate commitments

- Professional advisor outreach educating attorneys and financial planners

Organizations investing in systematic donor education secure significantly larger and more frequent endowment commitments than institutions conducting minimal cultivation.

Phase 3: Solicitation and Gift Closure

Asking for Transformational Commitments

Prioritize prospect cultivation:

- Major gift prospects capable of significant endowment contributions

- Planned giving prospects likely to include bequests

- Board members modeling endowment support leadership

- Campaign volunteers expanding solicitation capacity

- Professional advisors facilitating complex gift structures

Structure endowment proposals:

- Specific fund purposes aligned with donor interests

- Multi-year pledge options making large gifts achievable

- Blended gift approaches combining current and deferred components

- Professional recognition commensurate with commitment level

- Clear impact projections demonstrating mission advancement

According to fundraising research, endowment solicitations require more cultivation time but achieve significantly higher average gift sizes than annual fund requests.

Learn about alumni spotlight recognition that celebrates endowment donors effectively.

Phase 4: Stewardship and Growth

Sustaining Donor Relationships Long-Term

Implement systematic stewardship:

- Annual impact reports demonstrating endowment effectiveness

- Recognition events celebrating endowment donors

- Regular communications maintaining donor engagement

- Beneficiary connections creating emotional investment

- Recognition updates as endowment values grow

Monitor and report performance:

- Quarterly investment performance reviews

- Annual comprehensive reporting to donors and board

- Regular policy assessments ensuring appropriate management

- Comparative analysis benchmarking peer performance

- Transparent disclosure building stakeholder confidence

Organizations treating endowment building as ongoing programs rather than one-time initiatives develop substantially larger permanent funds generating greater mission impact.

Conclusion: Building Permanent Foundations for Mission Success

Endowment funds represent transformative financial instruments that convert generous one-time contributions into permanent income streams supporting organizational missions across generations. When schools, nonprofits, universities, and mission-driven organizations thoughtfully develop endowments through strategic fundraising, professional investment management, and appropriate donor recognition, they build financial independence enabling mission fulfillment that annual fundraising alone cannot achieve.

The strategies explored throughout this comprehensive guide provide frameworks for understanding endowment fundamentals, implementing sound financial management, cultivating major and planned gifts, and recognizing donors whose generosity creates lasting institutional impact. From establishing governance policies ensuring sustainability to developing recognition systems that honor transformational commitments appropriately, these approaches position organizations to build endowments that strengthen missions permanently.

Professional recognition systems serve institutions effectively for decades while honoring endowment donors whose gifts create perpetual impact

Ready to explore endowment donor recognition solutions for your organization? Modern digital recognition platforms help schools, nonprofits, and institutions honor every endowment contributor while creating engaging experiences that strengthen donor relationships and inspire continued generosity. Solutions like Rocket Alumni Solutions provide comprehensive platforms specifically designed for donor recognition, combining intuitive content management with professional hardware guidance ensuring successful long-term programs.

Whether you’re launching initial endowment fundraising, enhancing stewardship for existing donors, or developing recognition systems worthy of transformational gifts, digital donor walls offer capabilities that traditional approaches cannot match—unlimited capacity as endowments grow, instant updates demonstrating current impact, and rich multimedia connecting contributions to mission advancement meaningfully.

The most successful endowment programs share common characteristics: they provide donors with meaningful recognition celebrating permanent partnerships, communicate impact compellingly, maintain rigorous financial stewardship, and inspire continued philanthropic engagement. When institutions combine professional endowment management with thoughtful donor recognition and systematic stewardship, they build permanent financial foundations supporting missions across centuries.

Your supporters’ most generous contributions deserve recognition that celebrates their transformational impact appropriately while inspiring others to join your philanthropic community. With careful planning, professional management, quality recognition technology, and genuine commitment to donor partnership, you can develop endowments that secure your organization’s future while honoring those whose vision and generosity make lasting mission impact possible.

The transition from annual fundraising dependence to endowment-supported sustainability represents strategic investment in institutional permanence. Organizations embracing endowment development position themselves for long-term success, equipped with permanent capital that weathers economic challenges, supports mission excellence, and honors generous donors whose foresight ensures your institution thrives across generations.

Start planning your endowment development and donor recognition program today—your mission deserves the permanent support that thoughtfully built endowments provide, and your donors deserve recognition celebrating their transformational generosity.